While Việt Nam’s May trade data point to no further deterioration, there is still a long way to go to see a meaningful rebound in its trade cycle, HSBC said in a report.

The report said Việt Nam is not out of the woods yet. Despite no further deterioration in economic activity data in May, there is no clear sign that Việt Nam has bottomed out amid intensifying headwinds to growth. Indeed, sluggish external data remains the biggest downside risk to growth.

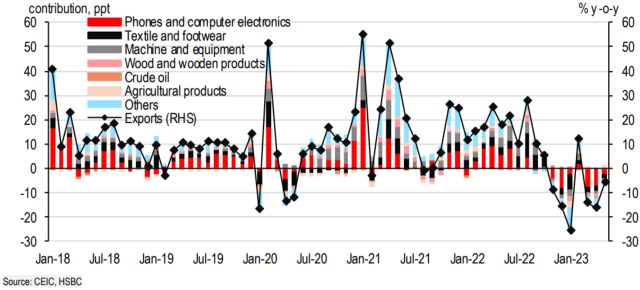

While exports fell 5.8 per cent year-on-year, a much smaller magnitude compared to the double-digit decline in previous months, base effects came to a partial rescue. Lingering broad-based exports weakness continues to weigh on Việt Nam’s growth prospects.

Indeed, none of the major categories, including electronics, machinery, textiles, footwear and wooden furniture showed signs of a meaningful rebound. Although exports data by country are not yet available in May, data as of April 2023 suggests substantial falling shipments in Việt Nam’s three largest exporting destinations including US, China and the EU. In particular, with a hefty share of 30 per cent, Việt Nam is particularly sensitive to a US economic slowdown.

Despite exports falling by single-digit, imports declined at a much faster pace of 18.3 per cent year-on-year. Arguably this is beneficial to Việt Nam’s trade surplus, registering at US$2.2 billion, twice 2022's monthly average.

Indeed, its improving trade balance is partially the reason why the Vietnamese đồng has stayed relatively stable amid strength in the US dollar in the past two weeks, outperforming peers like KRW and MYR, which are also highly correlated to RMB. However, given Việt Nam’s import-intensive nature in its manufacturing sector, the extreme weakness in imports signals a sluggish rebound in future exports.

That said, it is not all doom and gloom. Vietnam’s services sector remains a bright spot, partially offsetting some external weakness. However, there is a clear divergence between big-ticket items, such as automotive sales, and tourism-related services – a trend that is occurring in regional peers as well.

Positive influx of tourists

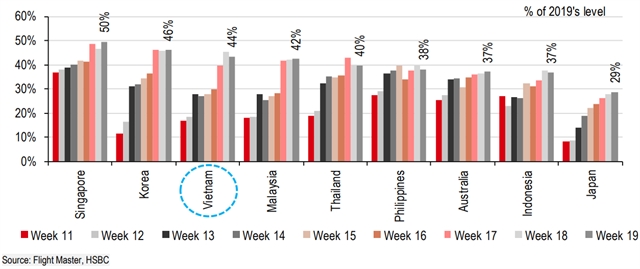

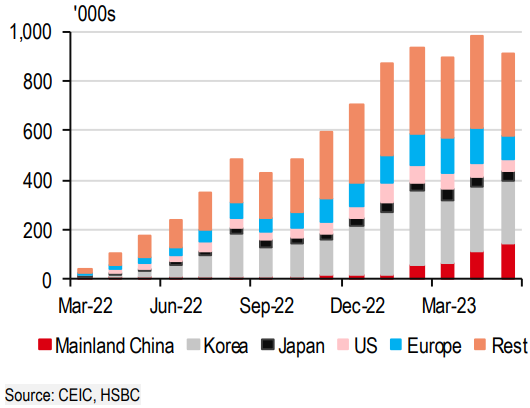

Encouragingly, Việt Nam continues to see a positive influx of tourists. Despite falling slightly from April’s high, Việt Nam welcomed more than 900,000 tourists again, bringing its tourism recovery to around 70 per cent of 2019’s level. In particular, tourists from mainland China recovered to 35 per cent of 2019’s level – though still slow, the progress is ongoing. Indeed, Việt Nam has made good progress to restore direct flights with China, now recovering to 44 per cent of 2019’s level.

Vietnam is leading Asia in terms of flight restoration with China. — Graphic of HSBC

Việt Nam has received 4.6 million international tourists YTD, approaching 60 per cent of its annual target of 8 million in 2023. With the approaching summer holidays and potential easing of visa restrictions, which are under consideration by the National Assembly, Việt Nam will likely see a punchier boost from international tourism, a much-needed support for its sharply slowing economy. The proposal includes extensions of e-visa to 90 days (from 30 days) and visa-free stays to 45 days (from 15 days), as well as expanding the list of countries eligible for e-visas, aiming to catch up with regional peers.

Tourist arrivals from mainland China are growing, though slowly. — Graphic of HSBC

Last, some good news is that inflation has been consistently cooling down. Headline inflation momentum remained flat in May, bringing year-on-year headline inflation to 2.4 per cent. Although housing and construction material costs rose 1.0 per cent month-on-month, mainly reflecting a one-month lag of electricity price hikes, significantly lower transport costs (-3 per cent month-on-month) offset some upside risks. Indeed, moderating inflation is one of the reasons behind the State Bank of Vietnam’s (SBV) second rate cut recently. — VNS

Read original article here